powered by

powered by

powered by

Flexible Expansion Capital for LedgerWay Clients

Flexible Expansion Capital for LedgerWay Clients

Flexible Expansion Capital for LedgerWay Clients

LedgerWay has partnered with Homegrown to give our clients access to fast, flexible growth financing — without the friction of traditional bank loans. As a LedgerWay client, you get exclusive rates and a streamlined application backed by your existing financial data.

LedgerWay has partnered with Homegrown to give our clients access to fast, flexible growth financing — without the friction of traditional bank loans. As a LedgerWay client, you get exclusive rates and a streamlined application backed by your existing financial data.

Up to $3M

Up to $3M

Substantial growth capital

Substantial growth capital

Keep Equity

Keep Equity

100% founder ownership

100% founder ownership

Apply Now

Apply Now

Built for Businesses Like Yours

Built for Businesses Like Yours

Built for Businesses

Like Yours

LedgerWay chose Homegrown because their model is designed for operators who've already done the hard work — your financials speak for themselves.

LedgerWay chose Homegrown because their model is designed for operators who've already done the hard work — your financials speak for themselves.

LedgerWay chose Homegrown because their model is designed for operators who've already done the hard work — your financials speak for themselves.

Keep your Equity

Stay in control of your company and your vision.

No Personal Guarantees

Transparent pricing with no origination fees, prepayment penalties, or surprise charges.

Large Checks

Supporting local businesses and communities. Your success is our success.

Longer Terms

No complicated paperwork. Accept your offer online and get back to running your business.

Keep your Equity

Get the capital you need without giving up ownership or control.

No Personal Guarantees

No origination fees, prepayment penalties, or surprise charges.

Large Checks

Access the funding you actually need to grow, not just a fraction of it.

Longer Terms

Accept your offer online and get back to running your business.

Keep your Equity

Get the capital you need without giving up ownership or control.

No Personal Guarantees

No origination fees, prepayment penalties, or surprise charges.

Large Checks

Access the funding you actually need to grow, not just a fraction of it.

Longer Terms

Accept your offer online and get back to running your business.

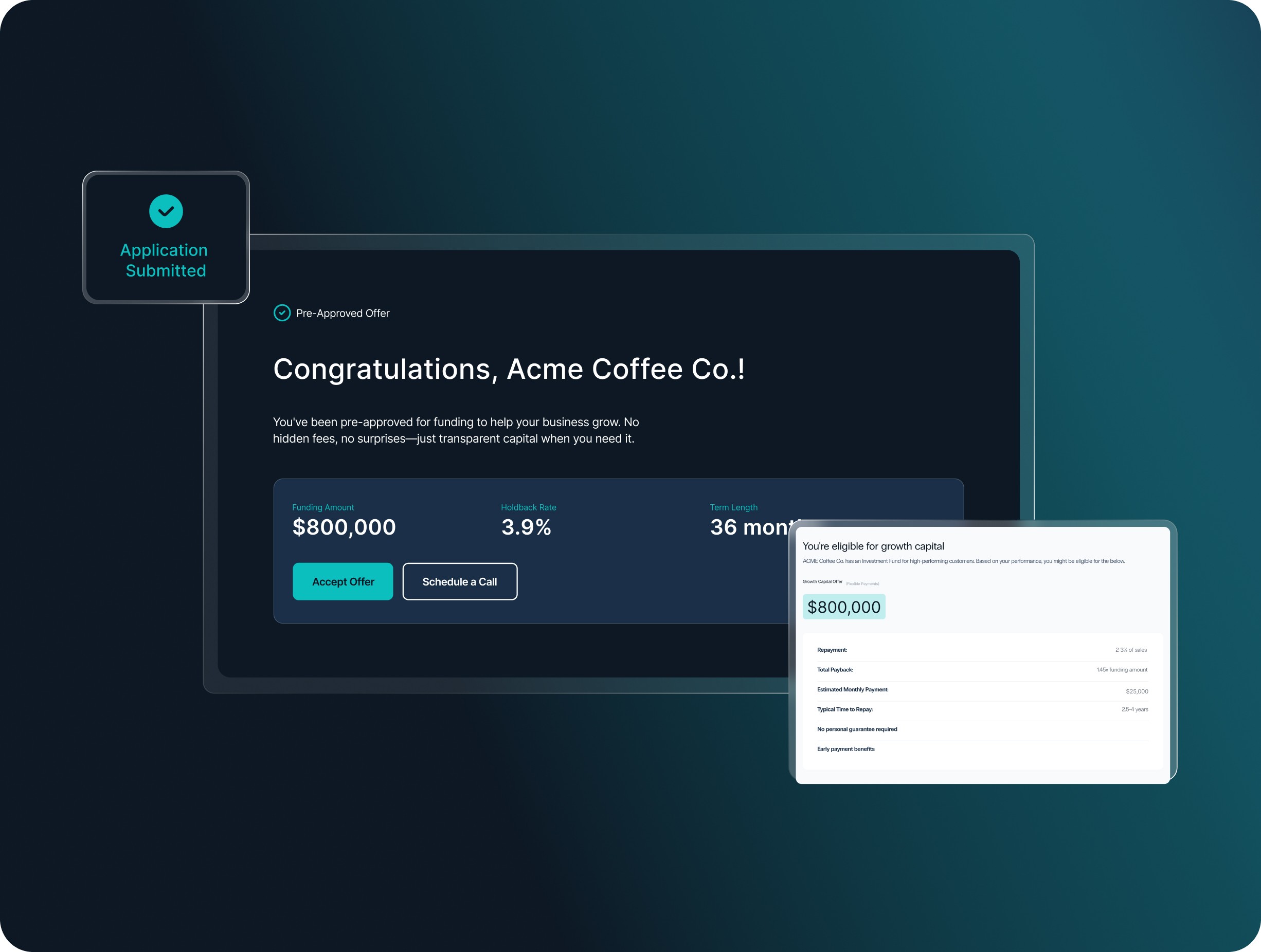

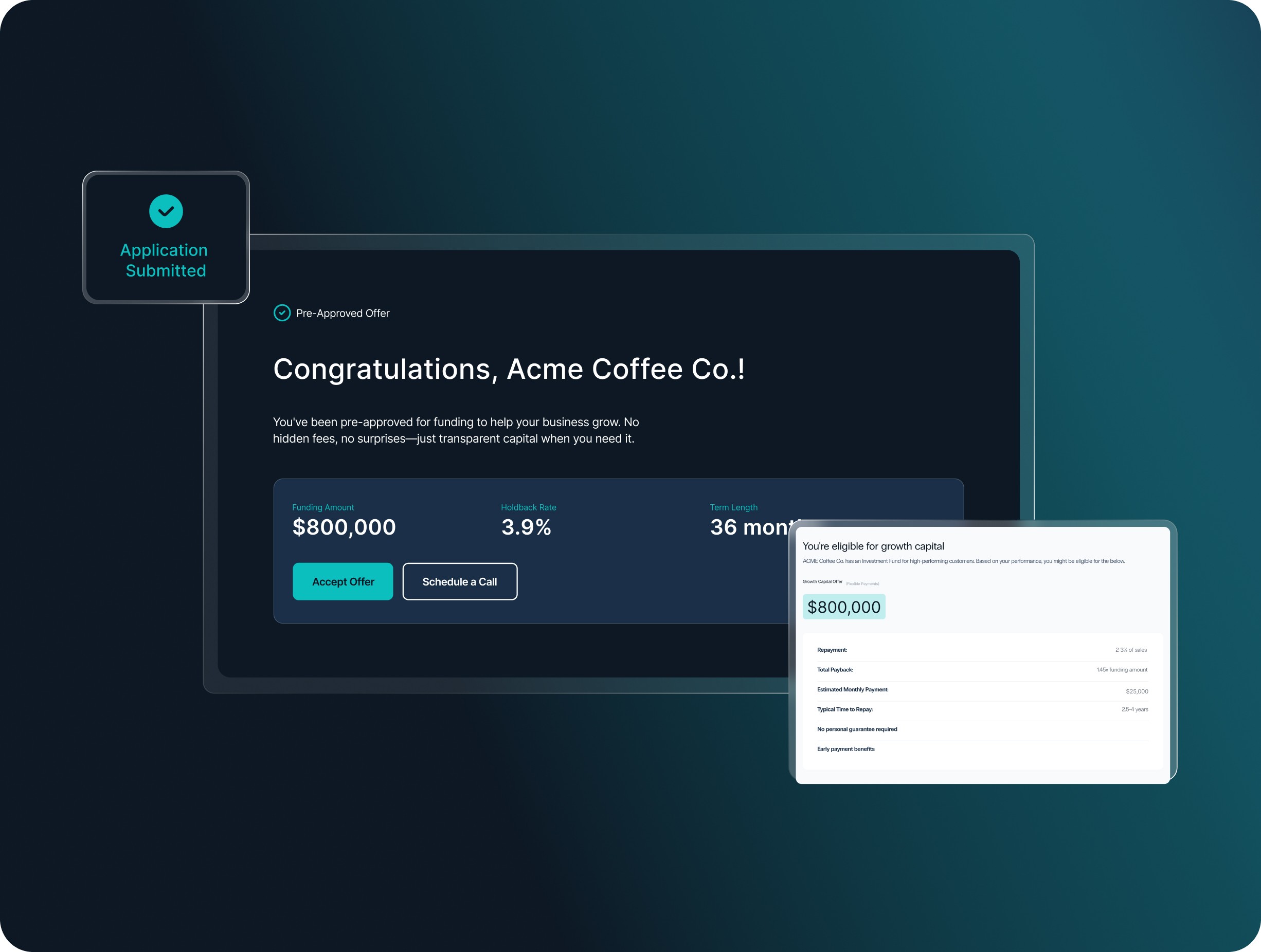

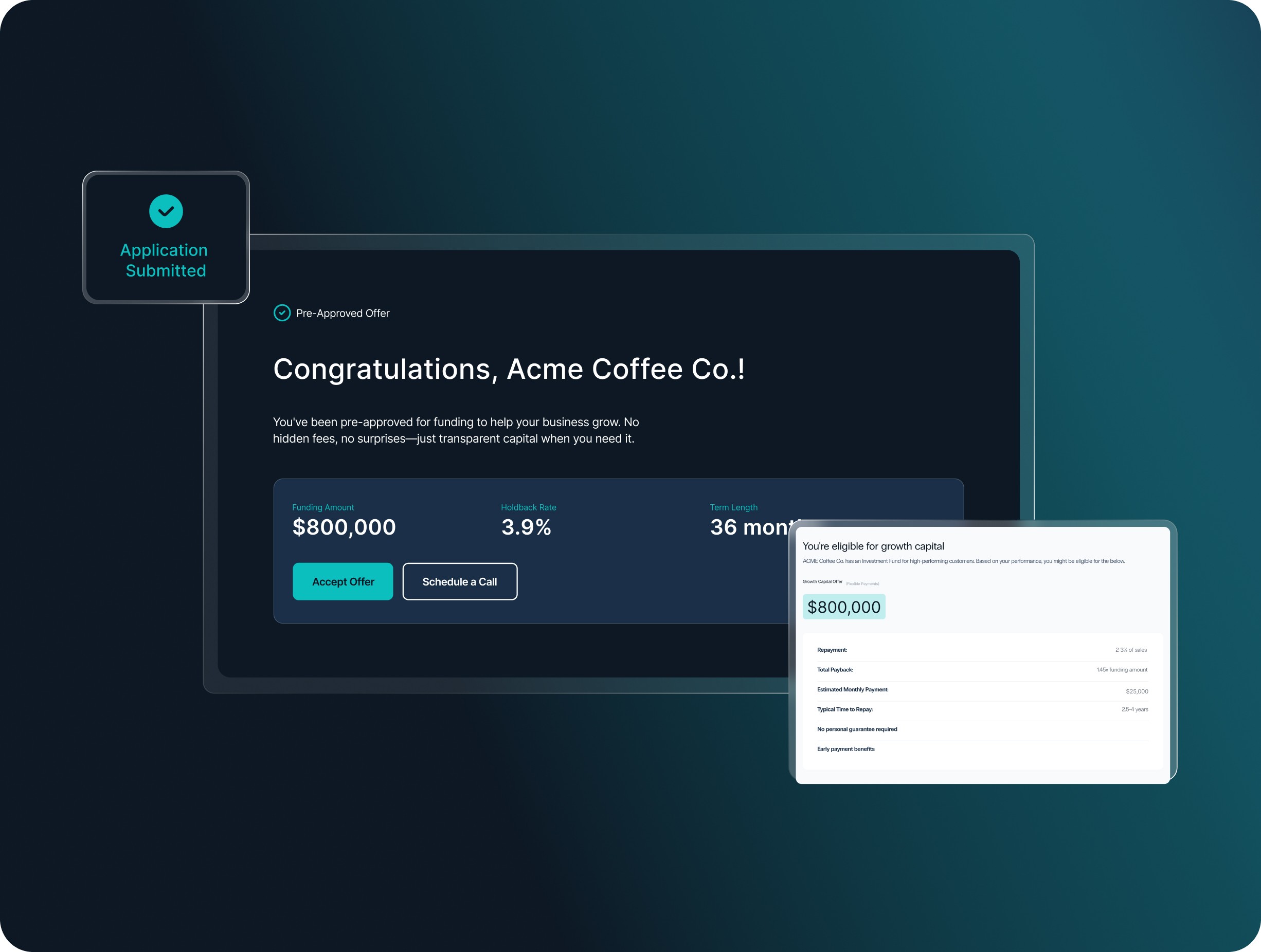

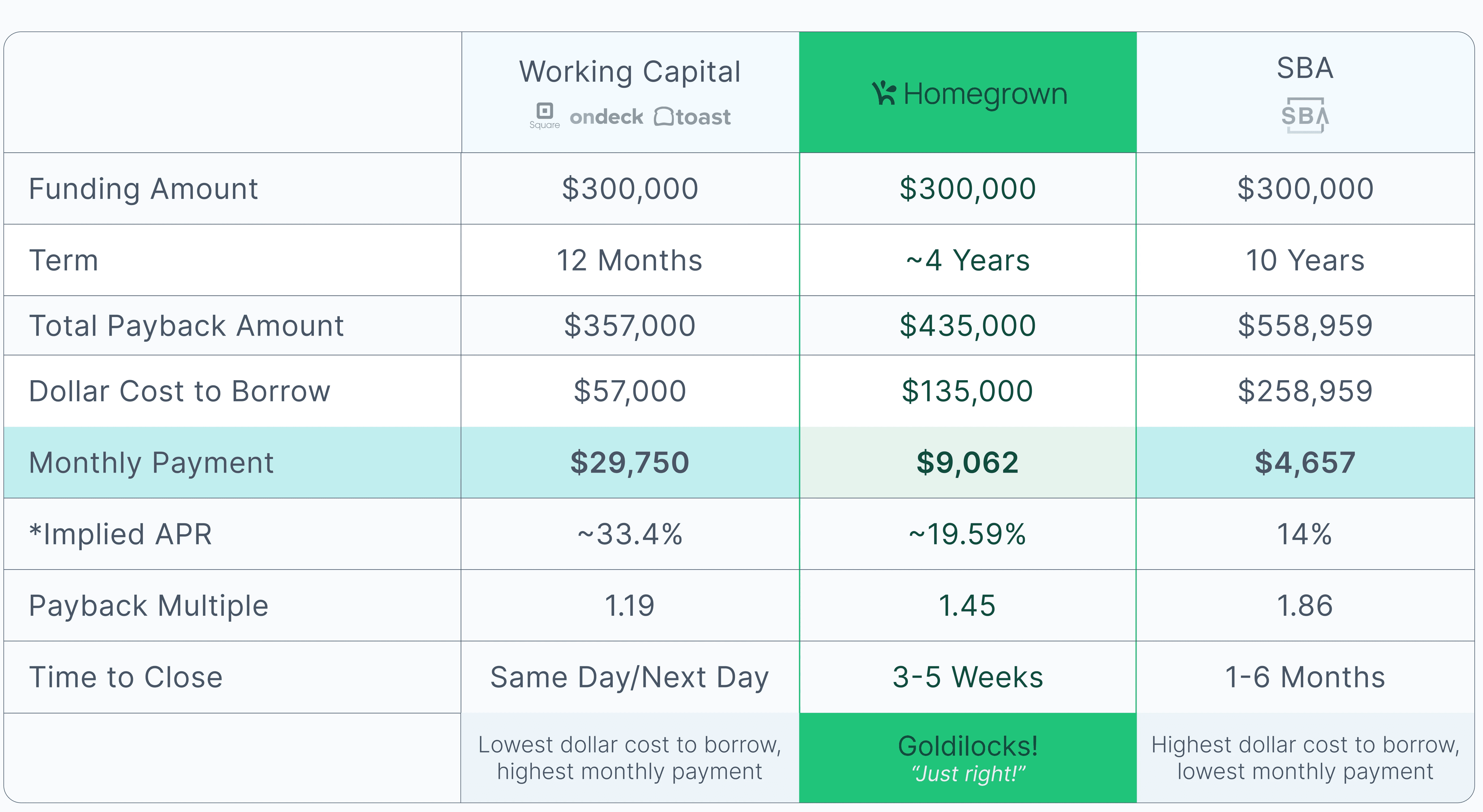

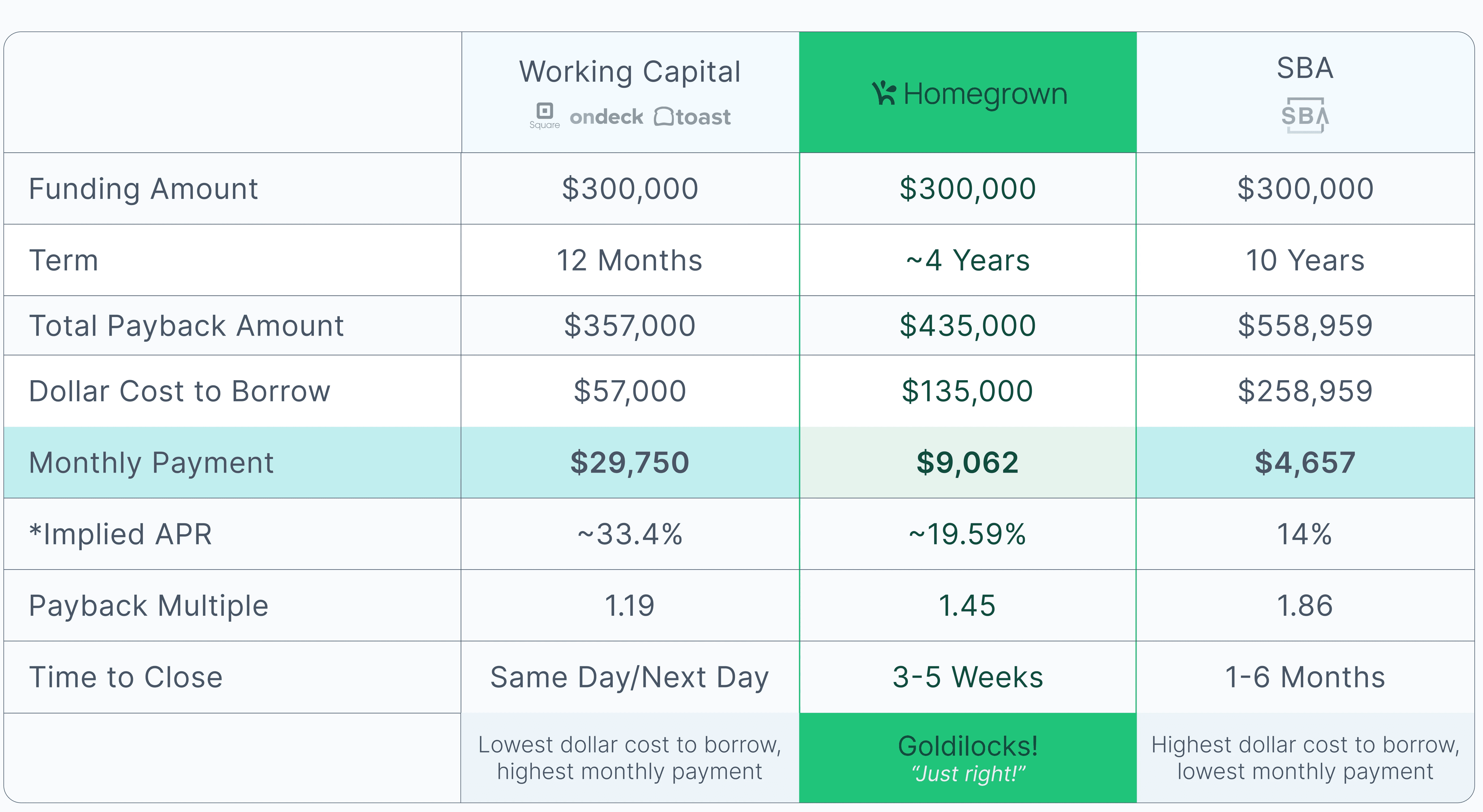

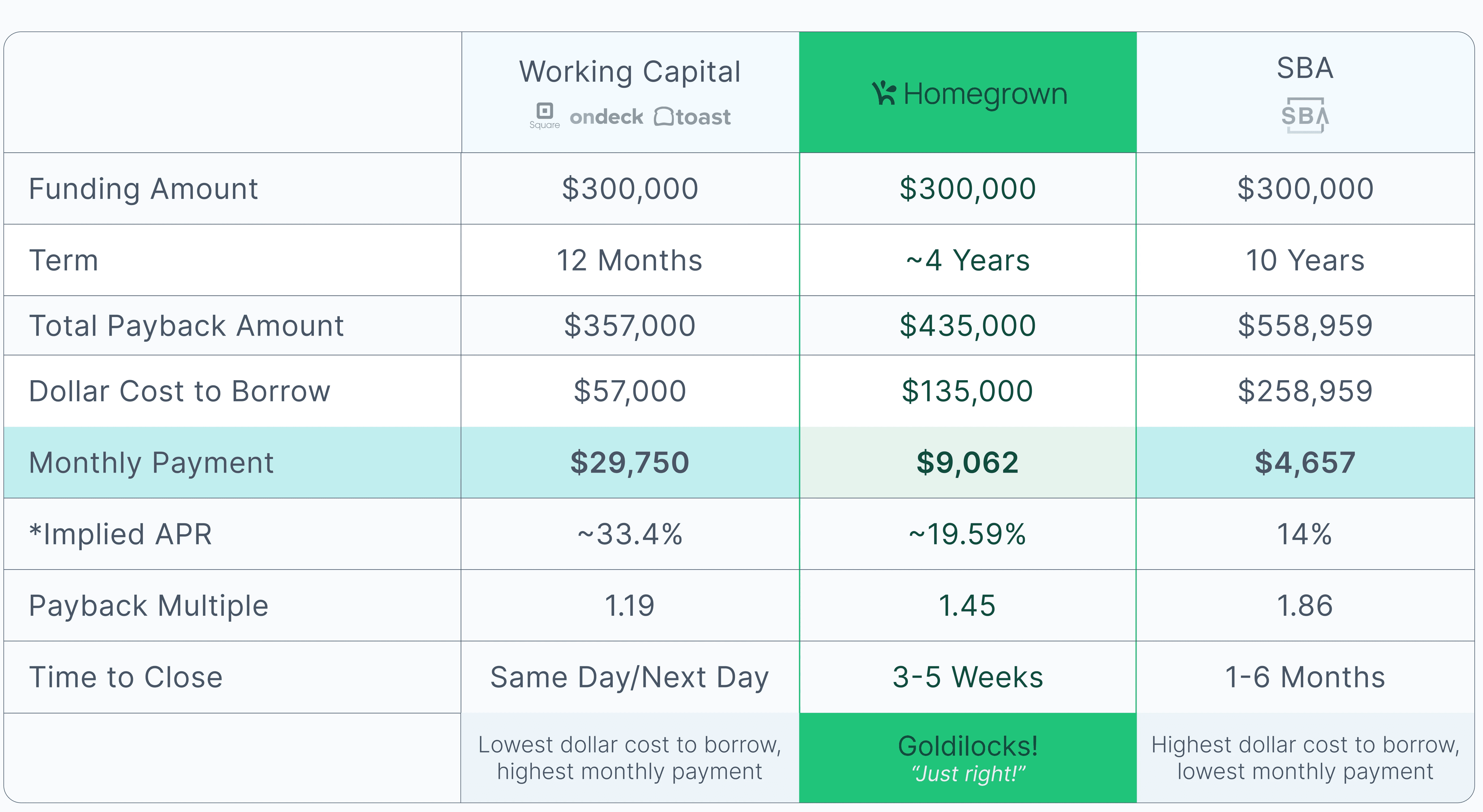

Homegrown is the Goldilocks financing

solution between MCA’s and the SBA

Homegrown is the Goldilocks financing

solution between MCA’s and the SBA

Homegrown is the Goldilocks financing solution between

MCA’s and the SBA

When you need a just right financing solution.

When you need a just right financing solution.

When you need a just right financing solution.

*All math above is shown without up-front fees

*All math above is shown without up-front fees

*All math above is shown without up-front fees

Our Products

Expansion

Open or acquire new locations without giving up equity or personal guarantees.

We provide growth capital on expected 3-5 year terms that preserve your cash flow.

Bridge

Get your tenant improvement dollars now, before your landlord reimburses you.

We’ll front your buildout costs so you're not waiting months for landlord reimbursement.

FAQs

What is Homegrown and how does it work?

Homegrown provides brick-and-mortar businesses with upfront capital for growth. Instead of fixed monthly payments, we're repaid through a percentage of your monthly sales. This means your payments flex with your revenue. When sales are strong, you pay more; when they're slower, you pay less. We succeed when you succeed.

What are the qualification requirements?

We work with established brick-and-mortar businesses that meet the following criteria:

2+ existing locations

3+ years in operation

Sufficient free cash flow to comfortably support repayment

We carefully structure deals to support your growth, not

strain your finances.

How does the repayment process work?

It's straightforward and transparent:

We integrate with your business to track monthly revenue

Around the 10th of each month, we send you an email with a clear breakdown of your previous month's revenue and the corresponding payment

We automatically draft the payment based on the agreed percentage

Plus, if you choose to pay off your balance early, you'll receive a discount.

Why choose Homegrown over a traditional bank loan?

Speed: We move much faster than banks

Flexibility: Less stringent requirements and no personal guarantee needed

Alignment: Payments adjust with your revenue, not against it

Service: We pride ourselves on responsive, personalized customer support

For most businesses, timing is everything. When you need capital to seize an opportunity, we're here for you.

Where's the catch?

There isn't one. We built Homegrown because we believe in brick-and-mortar businesses and saw a gap in the market. Traditional banks are slow and often inaccessible for growth-stage companies. Our model is designed to align our success with yours—we only win when you win. It's that simple.

FAQs

What is Homegrown and how does it work?

Homegrown provides brick-and-mortar businesses with upfront capital for growth. Instead of fixed monthly payments, we're repaid through a percentage of your monthly sales. This means your payments flex with your revenue. When sales are strong, you pay more; when they're slower, you pay less. We succeed when you succeed.

What are the qualification requirements?

We work with established brick-and-mortar businesses that meet the following criteria:

2+ existing locations

3+ years in operation

Sufficient free cash flow to comfortably support repayment

We carefully structure deals to support your growth, not

strain your finances.

How does the repayment process work?

It's straightforward and transparent:

We integrate with your business to track monthly revenue

Around the 10th of each month, we send you an email with a clear breakdown of your previous month's revenue and the corresponding payment

We automatically draft the payment based on the agreed percentage

Plus, if you choose to pay off your balance early, you'll receive a discount.

Why choose Homegrown over a traditional bank loan?

Speed: We move much faster than banks

Flexibility: Less stringent requirements and no personal guarantee needed

Alignment: Payments adjust with your revenue, not against it

Service: We pride ourselves on responsive, personalized customer support

For most businesses, timing is everything. When you need capital to seize an opportunity, we're here for you.

Where's the catch?

There isn't one. We built Homegrown because we believe in brick-and-mortar businesses and saw a gap in the market. Traditional banks are slow and often inaccessible for growth-stage companies. Our model is designed to align our success with yours—we only win when you win. It's that simple.

Homegrown Products

Homegrown Products

Expansion

Open or acquire new locations without giving up equity or personal guarantees.

Homegrown provides growth capital on expected 3-5 year terms that preserve your cash flow.

Bridge

Get your tenant improvement dollars now, before your landlord reimburses you.

Homegrown will front your buildout costs so you're not waiting months for landlord reimbursement.

FAQs

What is Homegrown and how does it work?

Homegrown provides brick-and-mortar businesses with upfront capital for growth. Instead of fixed monthly payments, we're repaid through a percentage of your monthly sales. This means your payments flex with your revenue. When sales are strong, you pay more; when they're slower, you pay less. We succeed when you succeed.

What are the qualification requirements?

We work with established brick-and-mortar businesses that meet the following criteria:

2+ existing locations

3+ years in operation

Sufficient free cash flow to comfortably support repayment

We carefully structure deals to support your growth, not

strain your finances.

How does the repayment process work?

It's straightforward and transparent:

We integrate with your business to track monthly revenue

Around the 10th of each month, we send you an email with a clear breakdown of your previous month's revenue and the corresponding payment

We automatically draft the payment based on the agreed percentage

Plus, if you choose to pay off your balance early, you'll receive a discount.

Why choose Homegrown over a traditional bank loan?

Speed: We move much faster than banks

Flexibility: Less stringent requirements and no personal guarantee needed

Alignment: Payments adjust with your revenue, not against it

Service: We pride ourselves on responsive, personalized customer support

For most businesses, timing is everything. When you need capital to seize an opportunity, we're here for you.

Where's the catch?

There isn't one. We built Homegrown because we believe in brick-and-mortar businesses and saw a gap in the market. Traditional banks are slow and often inaccessible for growth-stage companies. Our model is designed to align our success with yours—we only win when you win. It's that simple.

FAQs

What is Homegrown and how does it work?

Homegrown provides brick-and-mortar businesses with upfront capital for growth. Instead of fixed monthly payments, we're repaid through a percentage of your monthly sales. This means your payments flex with your revenue. When sales are strong, you pay more; when they're slower, you pay less. We succeed when you succeed.

What are the qualification requirements?

We work with established brick-and-mortar businesses that meet the following criteria:

2+ existing locations

3+ years in operation

Sufficient free cash flow to comfortably support repayment

We carefully structure deals to support your growth, not

strain your finances.

How does the repayment process work?

It's straightforward and transparent:

We integrate with your business to track monthly revenue

Around the 10th of each month, we send you an email with a clear breakdown of your previous month's revenue and the corresponding payment

We automatically draft the payment based on the agreed percentage

Plus, if you choose to pay off your balance early, you'll receive a discount.

Why choose Homegrown over a traditional bank loan?

Speed: We move much faster than banks

Flexibility: Less stringent requirements and no personal guarantee needed

Alignment: Payments adjust with your revenue, not against it

Service: We pride ourselves on responsive, personalized customer support

For most businesses, timing is everything. When you need capital to seize an opportunity, we're here for you.

Where's the catch?

There isn't one. We built Homegrown because we believe in brick-and-mortar businesses and saw a gap in the market. Traditional banks are slow and often inaccessible for growth-stage companies. Our model is designed to align our success with yours—we only win when you win. It's that simple.

FAQs

What is Homegrown and how does it work?

Homegrown provides brick-and-mortar businesses with upfront capital for growth. Instead of fixed monthly payments, we're repaid through a percentage of your monthly sales. This means your payments flex with your revenue. When sales are strong, you pay more; when they're slower, you pay less. We succeed when you succeed.

What are the qualification requirements?

We work with established brick-and-mortar businesses that meet the following criteria:

2+ existing locations

3+ years in operation

Sufficient free cash flow to comfortably support repayment

We carefully structure deals to support your growth, not

strain your finances.

How does the repayment process work?

It's straightforward and transparent:

We integrate with your business to track monthly revenue

Around the 10th of each month, we send you an email with a clear breakdown of your previous month's revenue and the corresponding payment

We automatically draft the payment based on the agreed percentage

Plus, if you choose to pay off your balance early, you'll receive a discount.

Why choose Homegrown over a traditional bank loan?

Speed: We move much faster than banks

Flexibility: Less stringent requirements and no personal guarantee needed

Alignment: Payments adjust with your revenue, not against it

Service: We pride ourselves on responsive, personalized customer support

For most businesses, timing is everything. When you need capital to seize an opportunity, we're here for you.

Where's the catch?

There isn't one. We built Homegrown because we believe in brick-and-mortar businesses and saw a gap in the market. Traditional banks are slow and often inaccessible for growth-stage companies. Our model is designed to align our success with yours—we only win when you win. It's that simple.

powered by

Have questions? Contact us at support@joinhomegrown.com

powered by

Have questions? Contact us at support@joinhomegrown.com

powered by

Have questions? Contact us at support@joinhomegrown.com