The Situation

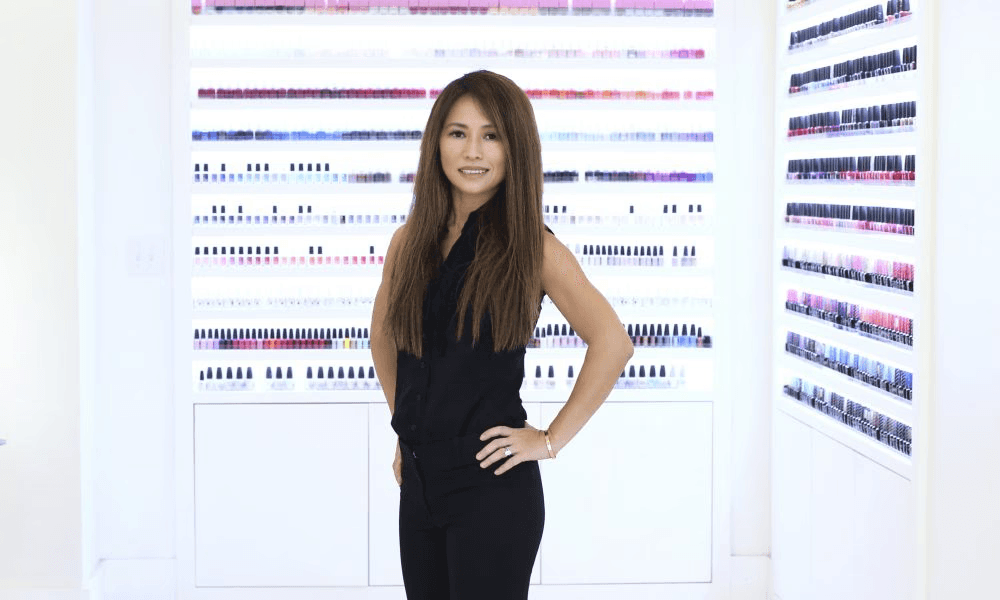

Sugarcoat is a full-service beauty brand based in Atlanta, GA. When husband-and-wife founders Peiru and Kevin Kim came to Homegrown, they were operating 15 locations across the Southeast.

Their business had survived the pandemic, even taking on merchant cash advances when things got tight. Now they were ready to grow again, with three new locations under construction in Brookhaven, Dunwoody, and Miami.

But post-COVID construction costs had skyrocketed. They found themselves about $1 million short of completing the buildouts. An investment group was ready to write a sizable check, in exchange for 40% of the entire company.

For months, that looked like their only option. The SBA process was too slow. High-interest loans were too predatory. And construction wasn't going to wait.

How we helped

Homegrown stepped in with capital to complete the three locations under construction using our Expansion product:

Provided the funding they needed to finish buildouts without giving up equity or dealing with high-interest short-term loans

Moved fast enough to meet their construction deadlines and keep contractors on site

We later implemented our Bridge product to help manage cash flow around tenant improvement (TI) allowances. We pulled forward the TI reimbursements from their landlords so construction could continue without waiting for the delayed payments to come through.

The result

Sugarcoat completed their three locations and avoided having to give up a big portion of their company. They've continued growing and now operate over 20 locations, with landlords actively seeking them out for new spaces. They're continuing to expand throughout the South.